What is a Trendline Indicator?

A trendline indicator is a technical analysis tool used by traders and analysts to identify the direction and strength of a trend in a financial market. It is based on drawing a straight line that connects two or more price points on a chart. The primary purpose of a trendline is to visually represent the general direction of price movement over a specific period.

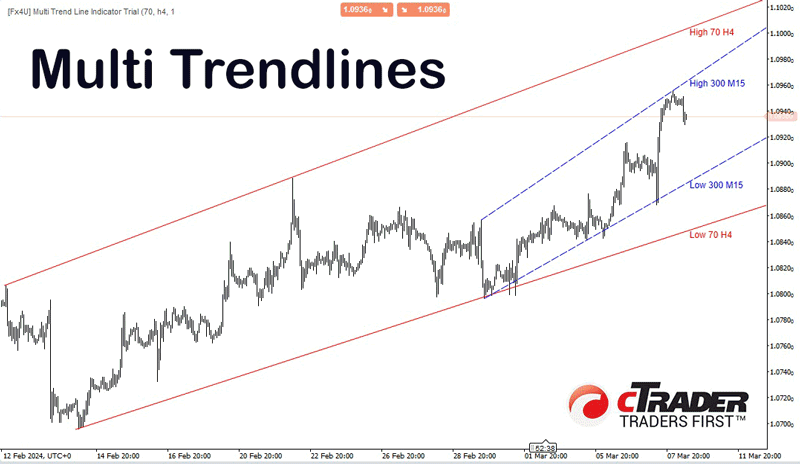

Multi Timeframe Trendline Indicator

The primary function of a multi-timeframe trendline indicator is to provide traders with a broader perspective of the market trends by aggregating information from various timeframes. By analyzing trends across multiple timeframes, traders can make more informed decisions about potential entry and exit points, as well as the overall direction of the market.

This type of indicator typically allows traders to customize the timeframes they want to analyze and plot trendlines accordingly. It can be a valuable tool for identifying key support and resistance levels, trend reversals, and trend continuations across different timeframes, thereby aiding traders in making more accurate trading decisions.

There are several types of trendlines, including:

Upward Trendline: This is drawn by connecting two or more successive lows on a price chart. It suggests an upward trend, indicating that prices are generally rising over time.

Downward Trendline: Conversely, a downward trendline is drawn by connecting two or more successive highs on a price chart. It suggests a downward trend, indicating that prices are generally falling over time.

Horizontal Trendline: Also known as support or resistance lines, these are drawn horizontally to indicate areas where price movement tends to stall or reverse.

Traders often use trendlines in conjunction with other technical indicators and analysis methods to make informed trading decisions. When a trendline is broken or breached, it may indicate a potential change in the direction of the trend, providing trading signals for investors.

How To Install & Remove

First, make sure you have the cTrader trading platform installed and then unzip the file and double-click on it to automatically install it onto the platform.

Any Questions?

If you have any questions, please first search our product help site for the answer, if you cannot find it, post a new question.